Summary

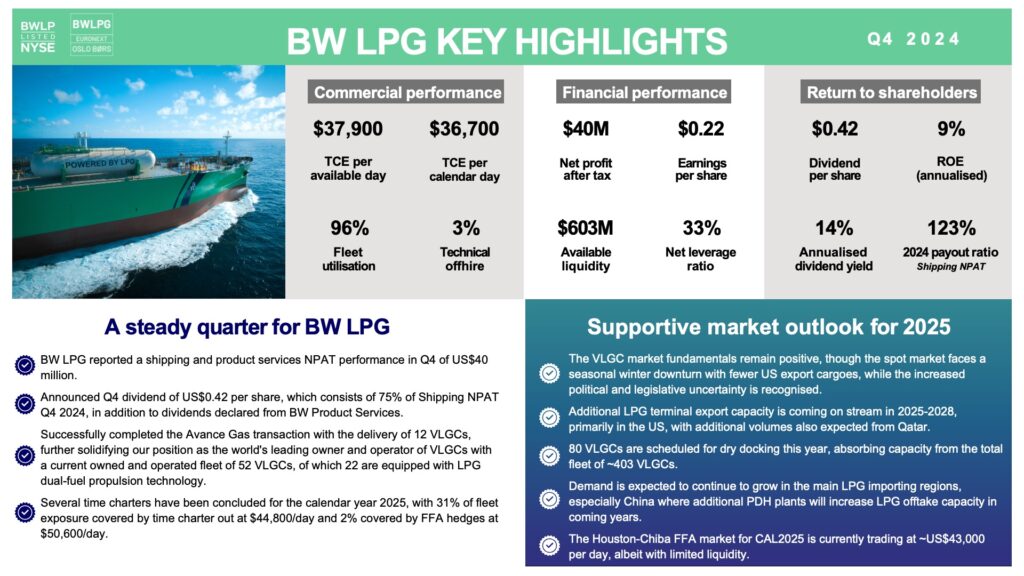

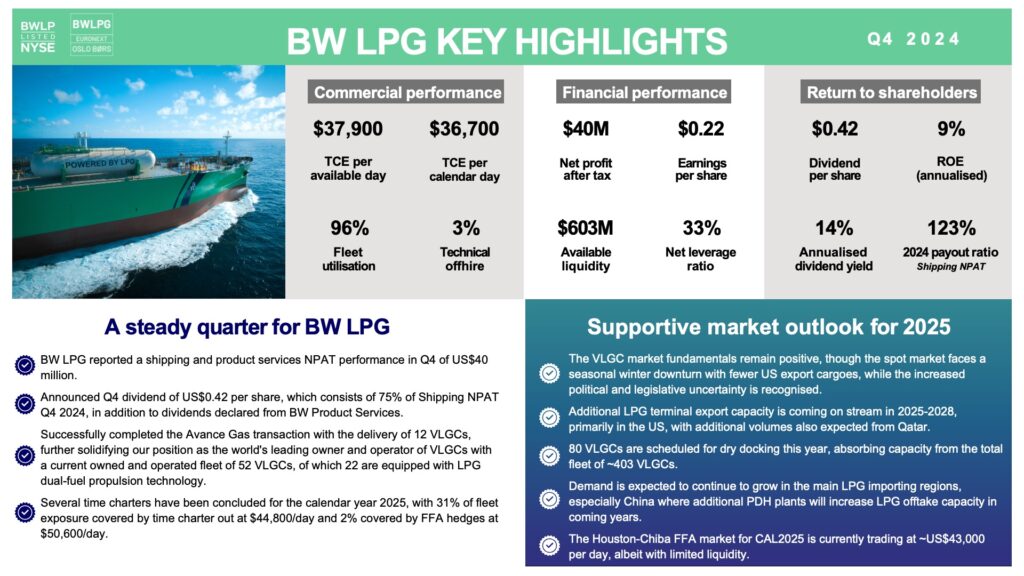

We published our Q4 2024 financial results today. It has been a steady fourth quarter for the company, with TCE income of US$37,900 per available day, reporting a shipping and product services NPAT performance of US$40 million in Q4. Following our performance for the fourth quarter, the Board has declared a dividend of US$0.42 per share, which consists of 75% payout of the Shipping NPAT topped up with additional dividend declared from BW Product Services.

We are also happy to report a strong year for our trading activity in Product Services generating a gross profit of US$145 million, which is US$119 million higher than in 2023, and a realised profit of US$94 million in 2024. This reflects a strong affirmation of our overall strategy, capturing value across the LPG value chain.

-

Q4 2024 Earnings Presentation

Download our earnings presentation here.

-

Q4 2024 Interim Financial Report

Download our interim financial report for the quarter here.

-

Q4 2024 Earnings Presentation Recording

Watch a recording of our earnings presentation for the quarter here.

-

Q4 2024 Earnings Presentation Transcript

Read the transcript of our earnings presentation for the quarter here.

Supportive Market Outlook for 2025

The fourth quarter of 2024 was relatively stable compared to the earlier quarters. Exports out of the US Gulf recovered early during the quarter, and while the US – Far East arbitrage narrowed, spot rates for VLGCs remained resilient, averaging around US$44,000/day on the Houston to Far East route.

Technical issues at one export terminal in the US Gulf lasted into October, negatively impacting VLGC loadings for said month. For the remainder of the quarter, however, VLGC loadings out of the US Gulf were robust, with December showing the highest VLGC loading count for a single month in 2024, contributing to exports out of the United States growing by 5.6% in Q4 2024 compared to Q4 2023 (VLGC only).

So far in 2025, exports out of the US Gulf have been impacted by seasonally cold weather and fog, which is normal for this time of the year. Towards the second half of 2025, more terminal export capacity is scheduled to come online, supporting further demand growth for VLGC transportation.

Middle Eastern LPG exports on VLGCs fell 0.5% in the fourth quarter of 2024, compared to the same period in the previous year, mainly due to OPEC+ production cuts remaining in effect. OPEC+ announced in December 2024 that it will be pushing back the start of unwinding the production cuts to April 2025.

The Panama Canal remains well supplied with water and increased vessel throughput during the fourth quarter compared to the preceding period. Moving into 2025, the Canal’s new locks are now operating at or near full capacity. This has resulted in increased volatility in transit auction fees and could generate fleet inefficiencies going forward.

Fleet Capacity

So far in 2025, one new VLGC has been delivered. For the remainder of the year, 11 new VLGCs are scheduled for delivery, making 2025 the lowest year for VLGC newbuilding deliveries since 2018. Well established shipbuilders are indicating deliveries no earlier than the end of 2027 for VLGCs.

Market Outlook

While fluctuations in spot rates are to be expected in the VLGC market, we view the prevailing market fundamentals as supportive. So far in 2025, the VLGC market has been shielded from the most disruptive geopolitical developments globally. However, we recognize the increasing political and legislative uncertainties that could impact the market and continue to monitor it closely. Furthermore, we anticipate that the additional export capacity coming on stream in the US later this year will support export growth for VLGCs in the high single digits for the full year.

Middle East LPG exports are expected to grow in the mid-single digits over the coming years, driven by higher gas production from new projects in Qatar and UAE.

In China, LPG inventories remain healthy but have been on a declining trend for the last nine months, with six more PDH plants slated for startup in 2025, adding to China’s LPG offtake capacity.

Furthermore, 80 VLGCs are expected to dry dock during 2025, potentially creating temporary trading inefficiencies for the overall fleet. By the end of Q4 2024, 9% of the global VLGC fleet was 25 years or older.

The current FFA market for CAL2025 is trading at equivalent to approximately US$43,000 per day, reflecting support to the current spot market. The spot market is expected to fluctuate, driven by weather changes, geopolitical situation, Panama Canal availability and other drivers of the VLGC market.